If you are someone who has or is planning to retire in Australia, it’s crucial to be aware of the latest legislative changes that may impact your financial situation. In response to the coronavirus pandemic, the Australian Government introduced temporary measures that affected superannuation income stream minimum withdrawals and Age Pension eligibility. As we move into the new financial year, here’s a summary of the significant changes that you should know:

Super Withdrawal Rates Back Up

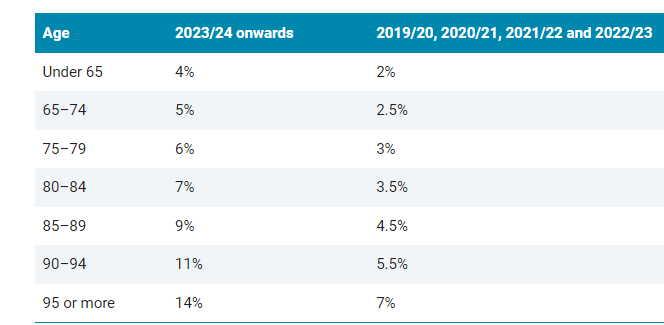

Over the last four financial years, the minimum amount to withdraw as a pension from superannuation has been reduced by the Australian Government. From the 1st of July 2023, the minimum withdrawal rates have now returned to pre-pandemic levels, shown in this table:

Transfer Balance Cap

Starting from 1 July 2023, the transfer balance cap is set at $1.9 million. This cap limits the total amount of super you can transfer into a tax-free retirement account over your lifetime. Keep in mind that most pensions and annuities count toward your transfer balance cap, while certain government payments and pensions received from foreign super funds are excluded.

Superannuation Guarantee Rates

As of 1 July 2023, the super guarantee rate stands at 11%, with further incremental increases of 0.5% scheduled each financial year until 2025 when it reaches 12%. These adjustments aim to reduce financial pressure on the Age Pension and help offset Australia’s aging population while improving financial outcomes at retirement.

Changes to Age Pension

The Age Pension is also subject to changes, including an increase in the eligibility age for those born on or after 1 January 1957. Additionally, on the 1st of July 2023, the Age Pension thresholds was adjusted.

Full Age Pension Income Threshold Increases

Singles threshold: +$14 per fortnight ($364 per annum).

Couples threshold: +$24 per fortnight ($624 per annum).

Pension recipients can add a Work Bonus Credit of $11,800 to these amounts until 31 December 2023.

Full Age Pension Assets Threshold Increases

Single homeowners threshold: +$21,750.

Single non-homeowners threshold: +$39,250.

Couple homeowners threshold: +$32,500.

Couple non-homeowners threshold: +$50,000.

Upper/Disqualifying Income Threshold Increases

Singles threshold: +$14 per fortnight ($364 per annum)

Couples threshold: +$24 per fortnight ($624 per annum).

Upper/Disqualifying Asset Threshold Increases

Single homeowners threshold: +$21,750.

Single non-homeowners threshold: +$39,250.

Couple homeowners threshold: +$32,500.

Couple non-homeowners threshold: +$50,000.

Take control of your retirement and reach out to us for options and the reassurance of an informed decision towards a more secure and prosperous retirement.