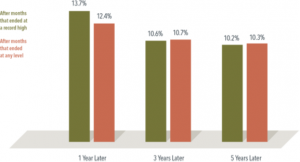

Many investors may think a market high is a signal stocks are overvalued or have reached a ceiling. But they may be surprised to find out that the average returns for the S&P 500 Index one, three, and five years after a new market high are similar to those after months that ended at any level.

In looking at all 1,000-plus monthly closing levels between 1926 and 2022 for the S&P 500 Index, 30% of the monthly observations were new market highs. After those highs, the average annualized compound returns ranged from almost 14% one year later to more than 10% over the next five years. Those results were close to average returns over any given period of the same length. When viewed in terms of the index simply having risen or fallen, the S&P 500 was higher a year after notching a record 81% of the time, and 86% of the time after five years.

Exhibit 1

All Rise

S&P 500 Index: average

annualized compound

returns, 1926–2022

History shows that reaching a new high doesn’t mean the market will then retreat. In fact, stocks are priced to deliver a positive expected return for investors every day, so reaching record highs with some regularity is exactly the outcome one would expect.

AUSTRALIA

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.